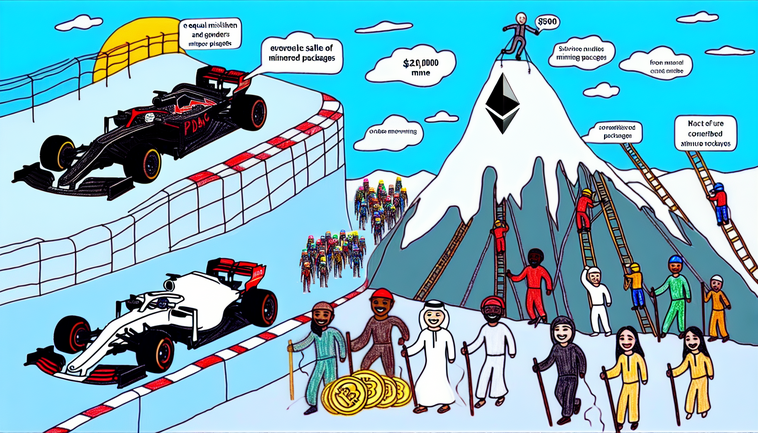

As the cryptocurrency arena heats up, three stories stand out: BlockDAG’s blockbuster sale of 20,000 miner packages, Ethereum’s buzz around a $5,000 price milestone, and WLFI’s stunning bid to reach $0.28. Each development taps into momentum—be it innovative mining models, market psychology or strategic partnerships—that are shaping trader sentiment and fueling fresh debates on where the market heads next.

BlockDAG has just crossed a landmark threshold by moving over 20,000 miner bundles in its ongoing presale, generating more than $415 million in backing. Such robust demand signals strong community confidence in its Block Directed Acyclic Graph protocol, which aims to enhance transaction throughput and decentralize competition in the mining sector. From my viewpoint, these sales figures underscore investors’ appetite for novel consensus designs that promise scalability without sacrificing security.

What truly amplifies BlockDAG’s narrative is its new partnership with BWT Alpine F1®. By aligning with a leading Formula 1 team, BlockDAG taps into global motorsport audiences to amplify brand recognition beyond traditional crypto circles. This blend of high-speed racing and cutting-edge ledger technology is more than a gimmick—it reflects a savvy marketing play that could set a precedent for future blockchain-sport collaborations. I believe this exposure will translate into broader adoption and community growth if BlockDAG can deliver on its technical promises.

Meanwhile, Ethereum’s push towards a $5,000 valuation has sparked spirited discourse among analysts. Bulls point to thriving decentralized finance activity, NFT trading volumes and the upcoming Shanghai upgrade as catalysts. Skeptics warn that macroeconomic headwinds and potential competition from emerging Layer 1s could dampen ETH’s ascent. In my estimation, while a mid-term rally to $5K is feasible under favorable conditions, traders should monitor key on-chain metrics—like network fees and staking rates—to gauge when exuberance might peak.

On another front, WLFI has captured traders’ attention with its rapid climb and lofty target of $0.28. The token’s recent momentum stems from renewed interest in its liquidity farming model and community-driven governance proposals. Yet the path to $0.28 remains steep, requiring sustained user engagement and clear utility beyond speculative trading. I see WLFI’s rally as emblematic of how mid-cap tokens can light up the market, but caution that success hinges on real-world use cases and developer updates that keep participants hooked.

When you compare these three dynamics—BlockDAG’s mining presale and F1 tie-up, Ethereum’s ambitious pricing outlook, and WLFI’s tokenomics drive—you see distinct strategies converging on a single goal: market relevance. BlockDAG leverages branding to accelerate adoption, Ethereum banks on network fundamentals to justify higher valuations, while WLFI leans into yield incentives and community governance. This trifecta highlights how innovation, narrative and utility intertwine in shaping crypto trends.

In conclusion, the crypto landscape is entering a phase where audacious collaborations, technical upgrades and speculative fervor coexist. BlockDAG’s milestone and Alpine F1® alliance illustrate how cross-industry marketing can propel a new protocol into the spotlight. Ethereum’s journey toward $5K underscores the delicate balance between on-chain growth and macro factors. And WLFI’s rally reminds us that community engagement can drive sharp price movements—but not without its share of risk. As these stories unfold, careful analysis and a long-term perspective will be crucial for anyone navigating this fast-moving market.